![NEITEC - Núcleo de Estudos Industriais e Tecnológicos | Escola de Química - UFRJ [NEITEC - Núcleo de Estudos Industriais e Tecnológicos | Escola de Química - UFRJ]](http://www.neitec.eq.ufrj.br/wp-content/themes/Neitec/img/logo.png)

![NEITEC - Núcleo de Estudos Industriais e Tecnológicos | Escola de Química - UFRJ [NEITEC - Núcleo de Estudos Industriais e Tecnológicos | Escola de Química - UFRJ]](http://www.neitec.eq.ufrj.br/wp-content/themes/Neitec/img/logo.png)

Artigo reproduzido de Yahoo Finances / QZ.COM / Eshe Nelson

General Electric’s time in the Dow Jones Industrial Average is finally up—because its share price has dropped too far down.

“Many people have lost faith in us,” John Flannery, the new CEO of the 126-year company, said earlier this year in the company’s annual report. “I have not.”

Despite Flannery’s optimism, getting booted from the Dow is a reflection of how far GE has fallen. When the index was started in 1896, GE, just a four years old, was one of the original members. For more than a century, it has consistently held a place in the Dow as one of America’s industrial titans.

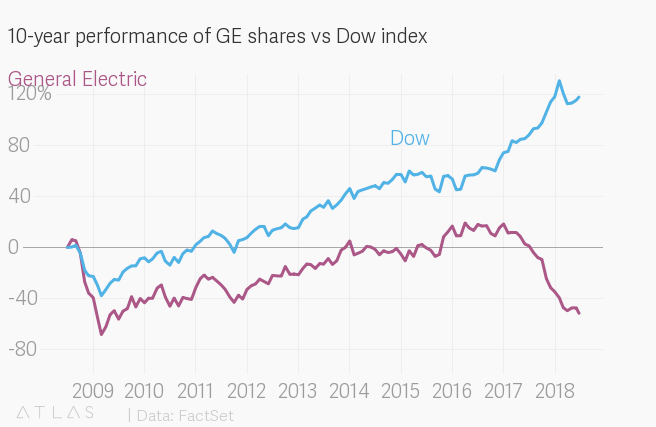

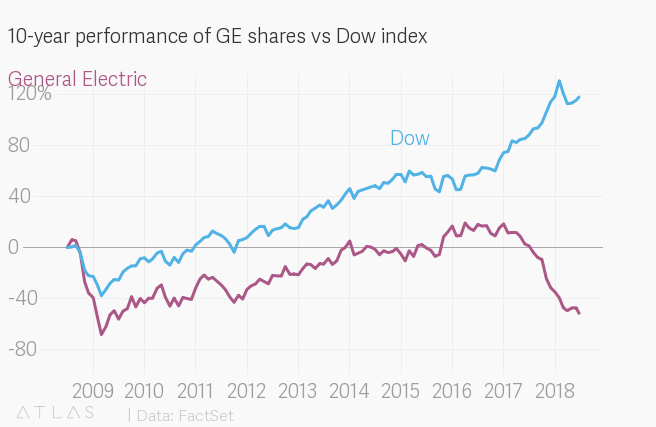

The reason GE is out is stock-market math. Last year, it was the worst performing stock in the Dow. Already this year it’s fallen another 25% and is lagging far behind the other 29 stocks the index.

GE will be replaced by Walgreens Boots Alliance, the retail company that specializes in pharmaceuticals. In the past 10 years, its share price has doubled, as GE’s has halved. As S&P Dow Jones Indices explains, Walgreens Boots will “contribute more meaningfully to the index” because the relative prices of all the stocks matter its overall composition. Even though the company’s share price has fallen 11% this year, the switch will better reflect the changing nature of the US ecnomony, in which healthcare companies have become more important.

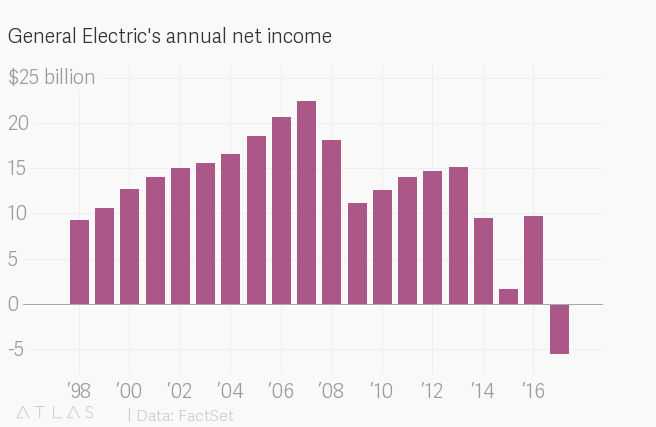

GE, in the Dow consistently since 1907, has been served eviction notices twice before. This third time might stick. Its recent credit ratings have seen GE repeatedly downgraded and given a negative outlook. The company is dealing with cash problems, withering demand for power turbines, and a still-bloated portfolio of businesses it wants to trim down.

At the end of last year, GE recorded a $10-billion quarterly loss, in large part due to a massive charge relating to an US Securities and Exchange Commission investigation into its insurance unit that will hang on the balance sheet for seven more years. Fitch, which downgraded GE’s credit rating just last week, said the company needs to go through an “extensive restructuring” and investors should be prepared for more bad earnings reports.

Time out of the spotlight might be just what the CEO needs to figure out what kind of company GE can be.